Low-deposit Mortgages Wellington

financial expertise

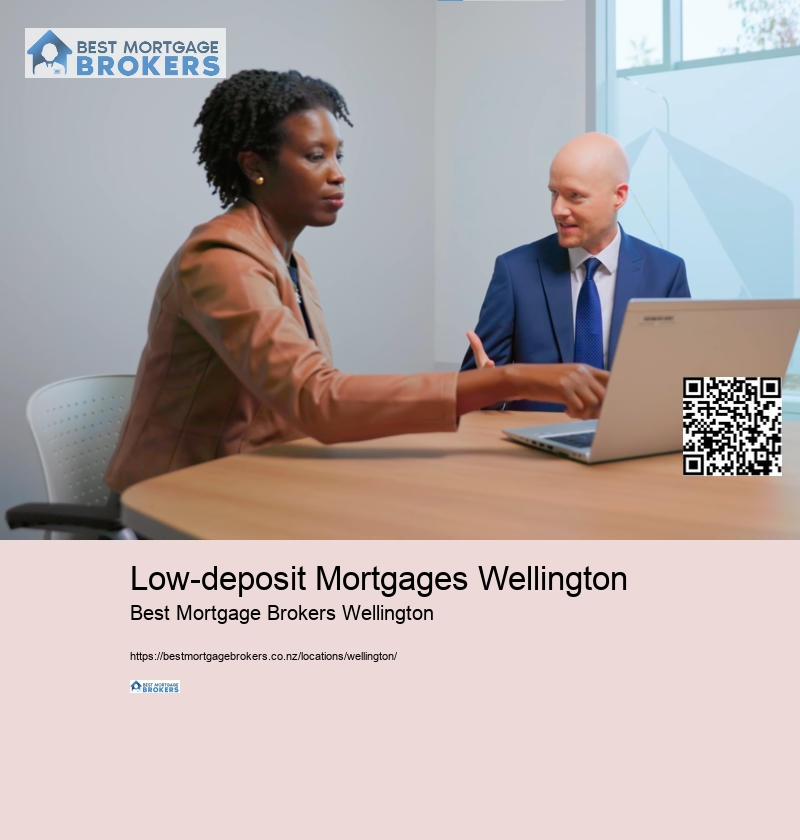

Our team is dedicated to assisting clients in preparing all essential documents, such as proof of income, bank statements, tax returns, and identification records. We emphasize the importance of accuracy and completeness in all paperwork to prevent any issues during the underwriting process. Our goal is to make the documentation process as stress-free as possible for our clients, offering support and guidance every step of the way.

This thorough review helps us address any discrepancies or missing information promptly, further streamlining the process. By proactively handling documentation, we ensure that our clients' mortgage applications progress smoothly and efficiently, bringing them closer to achieving their homeownership goals.

Low-deposit Mortgages Wellington - debt consolidation

- financial advice

- financial planning process

- financial advisor

- investment property

- home loan

- first home buyers

- property investors

- lending

We understand the importance of these post-closing tasks in ensuring that our clients have a smooth experience after securing their mortgage. One crucial responsibility we take care of is ensuring that all necessary documentation is accurately filed and stored for future reference.

Additionally, we assist our clients in setting up their mortgage payment schedules and provide guidance on how to make timely payments to avoid any unnecessary complications. Our team is dedicated to being a reliable resource for our clients even after the mortgage closing, offering support and assistance whenever needed.